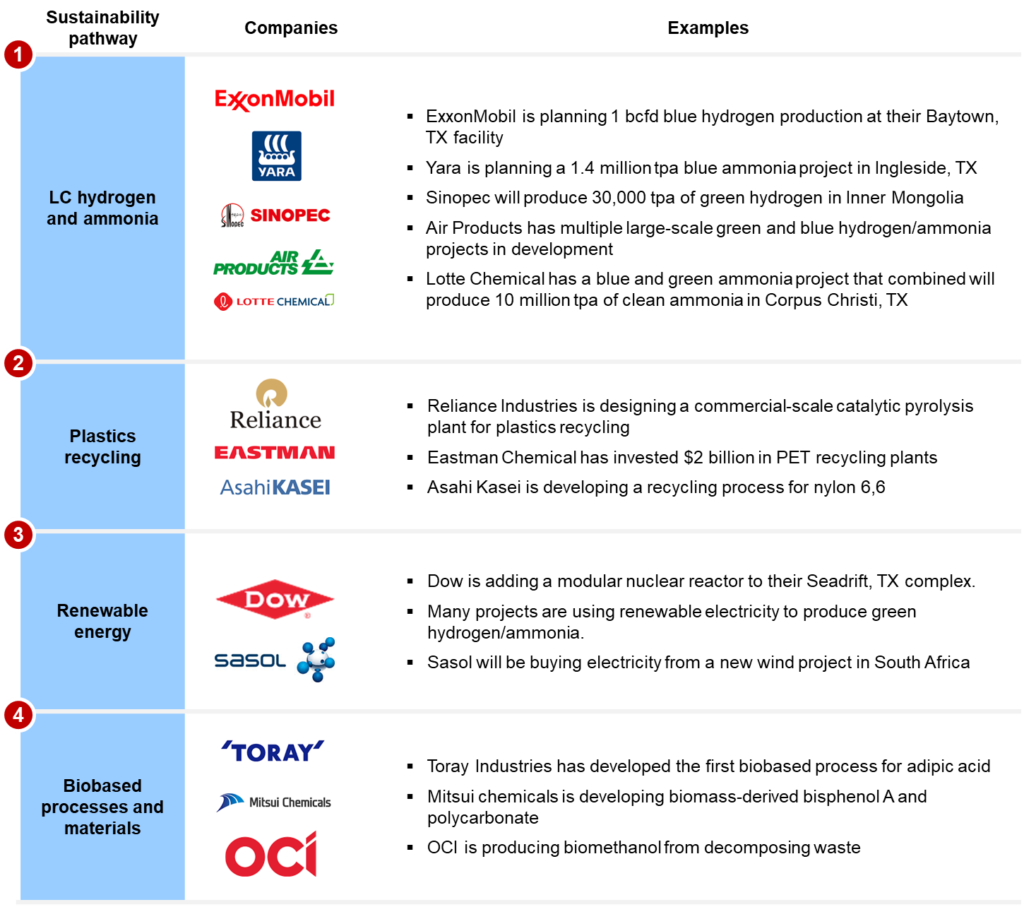

One of the largest problems affecting the chemical industry in recent years has been the pressure to transition toward clean energy and reduce carbon emissions. More than 20 of the firms in the Chemical & Engineering News (C&EN) Global Top 50 have made investments recently in sustainability or currently have sustainability projects in development. At a high level, we have four major pathways to sustainability: (1) Decarbonizing operations by using low-carbon (LC) hydrogen or adapting carbon capture technology to reduce their greenhouse gas (GHG) emissions. (2) Developing recycling processes to recycle plastics and materials which are difficult to break down using traditional means. (3) Transitioning from dirty fossil fuels to sustainable renewable energy sources. (4) Using biobased processes and feedstocks instead of traditional petrochemical processes and feedstocks.

We take a deeper dive into these initiatives. (1) Carbon capture and storage (CCS) is the process of removing CO2 from industrial emissions and storing it deep underground within geological formations, and chemical firms are using this technology to decarbonize their operations. ExxonMobil is looking to profit off the increasing demand for CCS by providing transport and storage of CO2 to third parties. CF Industries, Linde, and Nucor have all signed contracts with ExxonMobil for the transport and storage of their CO2 emissions totaling 5 million metric tons per annual (tpa). Air Liquide has plans to implement their Cryocap technology, which uses cryogenic temperatures to separate CO2, at a Holcim cement factory in Belgium.

A major factor for the sustainability transition of the chemical industry is production of and access to clean hydrogen. Hydrogen not only has the most potential for replacing natural gas as the primary fuel source for energy intensive processes, but it is also needed for producing many common chemicals including ammonia. Green hydrogen is produced through electrolysis of water and uses electricity from renewable sources to limit CO2 emissions. Some of the firms making the largest investments into green hydrogen are Sinopec, Air Products & Chemicals, and Linde.

Blue hydrogen is LC hydrogen produced by reforming natural gas and using CCS to limit the overall CO2 emissions. Linde plans to build a reactor to produce blue hydrogen at their Alberta site which will provide LC hydrogen fuel for Dow’s nearby ethylene cracker. ExxonMobil is planning to add up to 1 billion cubic feet per day (bcfd) of blue hydrogen production to their Baytown, Texas facility to help reach their goal of net-zero GHG emissions by 2050.

Blue and green ammonia are made using hydrogen of the same color. With the boom of the fertilizer market, many LC hydrogen projects are tied into producing LC ammonia. Air Products & Chemicals, CF Industries Holdings, and Lotte Chemical all have plans to produce both blue and green ammonia in the U.S. OCI and Yara each have plans for blue ammonia production.

(2) Some companies are reducing their carbon footprints by investing in recycling practices. LyondellBasell and Reliance Industries both have developed their own catalytic processes for recycling plastics. Eastman Chemical has invested $2 billion between 3 separate plants that will use both mechanical and chemical methods to recycle polyethylene terephthalate (PET). Borealis has been acquiring existing recycling plants to meet their goal of producing 600,000 tpa of plastics from recycled and recovered materials by 2025.

(3) Many companies have already been mentioned for using renewable energy to produce green hydrogen and ammonia. There are a couple of other notable renewable energy projects not related to LC hydrogen initiatives. Dow plans to build a modular nuclear reactor at their complex in Seadrift, Texas that will supply heat and steam for various processes and cut their CO2 emissions by 440,000 tpa. A new wind energy project will provide power for the air separation units that provide oxygen to Sasol’s site in Secunda, South Africa.

(4) There are a few companies that are looking to replace traditional petrochemical processes and feedstocks with more sustainable biobased alternatives. Notably, Mitsui Chemicals is working with another Japanese firm, Teijin, to develop biomass-derived bisphenol A and polycarbonate. Mitsui has also been feeding their ethylene crackers with vegetable and residual oils for over a year now. OCI hopes to market their biomethanol, that is produced using renewable methane from decomposing waste, as a LC fuel source for ships. Toray Industries announced what they call the first biobased adipic acid last year. Adipic acid is one of the materials needed to make nylon 6,6. Toray’s process that uses microorganisms turn sugar into adipic acid is still in early stages of development, but they hope to be start production by 2030.

The chemical industry’s major players are approaching sustainability through a combination of various initiatives. The use of renewable energy and CCS will allow the industry to meet their high energy demand without producing excessive GHG emissions. Improved recycling practices will allow plastics producers to meet demand while reducing waste and dependence on petrochemical feedstocks. Renewable energy will allow the industry to lessen its dependence on fossil fuels. Biobased processes could potentially replace current processes that are reliant on fossil fuel derived feedstocks.

It is worth noting that many of the European, Japanese, Korean, and North American companies in the C&EN’s Global Top 50 have sustainability initiatives in the works. Sinopec’s 30,000 tpa green hydrogen project in Inner Mongolia was the only sustainability project from a Chinese firm mentioned in the C&EN list. Overall slow adoption of sustainability initiatives by Chinese firms could be due to the difficulties they faced from government enforced lockdowns caused by the COVID-19 pandemic last year. It is also possible that many of the Chinese firms have chosen to prioritize rapid growth over adopting sustainable practices. Regardless of the reason, it will be imperative for more of the large Chinese chemical companies to join the rest of the world in adopting sustainable practices for global climate goals to be met.

ADI Chemical Market Resources is a prestigious, boutique consulting firm specializing in chemicals, petrochemicals, polymers, and plastics since 1990. We bring deep, first-rate expertise in a broad range of markets including sustainability, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

Our former industry-leading conference, FlexPO+ is now a part of the ADI Forum, one of Houston’s distinguished industry conferences, bringing c-suite executives from across the value chains in oil & gas, energy transition, and chemicals together for meaningful, strategic dialogue.

Subscribe to our newsletter or contact us to learn more.

– Piercen Hoekstra