Basell unveils novel Ziegler-Natta PP catalysts

Basell introduced a new Ziegler-Natta catalyst family based on ethyl-benzoate as an internal donor that improves polymer morphology and bulk density. The proprietary ethyl-benzoate catalysts are designed specifically for gas-phase polypropylene processes and are also suitable for liquid-phase polymerization.

Basell has developed this catalyst on an advanced magnesium chloride support and according to the company, this translates into better plant operability and higher throughput.

The new family of Ziegler-Natta catalysts extends the range of offerings marketed by Basell under the Avant trademark. These advanced catalyst systems include (1) Avant ZN – Ziegler-Natta catalysts for polypropylene, (2) Avant Z – Ziegler catalysts for polyethylene, (3) Avant C – Chromium catalysts for polyethylene, and (4) Avant M – Metallocene catalysts for polypropylene. Avant catalysts are manufactured in Italy, Belgium, Germany, and the United States.

Comments: With the introduction of the ethyl-benzoate catalysts, Basell is the only company offering four Ziegler-Natta polypropylene catalyst families including (1) phthalate, (2) diether, (3) succinate, and (4) ethyl benzoate.

Phthalate catalysts are typically characterized as 4th generation catalysts and use phthalates as the internal donors. Such catalysts provide good morphology control and may be considered multi-purpose catalysts.

Diethers, on the other hand, are 5th-generation catalysts and use diethers as internal donors. These catalysts have an excellent hydrogen response and extended life and tend to produce resins with narrow molecular weight distribution.

Succinates are also 5th generation, and as the name implies use succinates as the internal donor. These catalysts produce resins with high isotacticity and a broader molecular weight distribution compared to phthalate systems which makes them highly versatile and well-suited for a variety of applications, especially film.

Ethyl benzoates are 3rd generation catalysts producing resins with broad molecular weight distribution and allow for excellent operability and morphology control.

In general, phthalate and diether catalysts produce resins with narrow MWD, while succinates and ethyl benzoates produce a much broader MWD. Narrow MWD resins are useful for applications such as fibers and cast film. Broader MWD resins are generally more useful for BOPP, pipe, and thin-walled injection molding applications.

Borealis announces the first polypropylene product made from natural gas

As a result of cooperation between Lurgi, Statoil, and Borealis, the world’s first Borstar® polypropylene cups were created using propylene from Lurgi’s new MTP® Methanol-to-Propylene) process.

Lurgi developed the MTP process that uses methanol as the feedstock produced from natural gas. Using the MTP process methanol is converted to propylene. The viability of this process was demonstrated by Lurgi at an MTP demonstration unit, operated jointly by Statoil and Lurgi, at Statoil’s methanol plant in Norway.

To confirm the quality of the propylene obtained in the demonstration unit, samples were sent to Borealis’ Innovation Centre in Rønningen, Norway. Using Borealis’ Borstar process propylene was polymerized to polypropylene and converted into thermoformed cups.

Borealis has been producing propylene using dehydrogenated propane at its 480,000 MT/year facility at Kaol, Belgium. The company has no current plans for producing polypropylene using the MTP process on a commercial scale.

After having demonstrated the high quality of the propylene, Lurgi is now in a position to offer the MTP process on a commercial scale. According to Lurgi, the most favorable conditions for the MTP process are in locations with stranded or isolated gas fields and the natural prices are below $1 per million BTU.

Comments: Lurgi has been working on the development of methanol to olefins technology since 2001, and this is a very big achievement in their efforts.

The demand for propylene has been increasing and there are different processes to produce chemical-grade propylene including MTP. The different processes include (1) light olefins cracking, (2) heavy olefins cracking, (3) propane dehydrogenation, (4) metathesis, (5) skeletal isomerization, and (6) refinery recovery.

While this technology has been successful, Borealis has no intention of using the MTP process on a commercial scale. This process might be beneficial in regions that have access to cheaper natural gas however the natural gas prices are high in North America.

Borealis selects Tecnimont to build a polyethylene plant at Schwechat, Austria

Borealis awarded a contract to Tecnimont to build its previously announced 350,000-MT/year polyethylene (PE) plant at Schwechat, Austria.

The company will spend €200 million ($228 million) at Schwechat on the PE plant and the previously announced expansion of its polypropylene (PP) plant by 90,000 MT/year, to 300,000 MT/year. Construction will start in 2004 and is scheduled for completion in 2005.

Comments: In July 2003, Borealis announced an investment of €200 million in the construction of the new polyethylene plant and expansion of its polypropylene plant. The PE plant to be built will be based on its proprietary bimodal-PE technology. Upon completion of the new plant, Borealis will phase out two older LDPE lines and an HDPE line at the production site in Schwechat, resulting in a net capacity increase of around 150,000 MT/ year of polyethylene.

Awarding the contract to Tecnimont indicates progress toward completing its announced PE plant. For more information, refer to Volume 1 – Issue 15 of PO&E Strategic News Analysis

A note from Balaji, our staff cartoonist

We want to thank all of our clients for making this service a success beyond our expectations. We are pleased to inform you that we have reached a circulation of 2,300 individual emails worldwide in the short period of 3 months. In addition, most of the major organizations have it on their intranets websites for internal access. Thank you for your response.

To our pleasant surprise, we received numerous comments about our cartoons.

We are pleased to know you are enjoying our cartoons. We, as a bunch chose a profession that is generally considered– dull, rigid, structured, and devoid of any emotions. That explains why there are popular TV shows like LA Lawyers, New York Police Department, and General Hospital etc. But no one heard of shows like “Gulf Coast Chemists”, “Pipe Line Pioneers” “High Pressure Dare Devils” and so on. My wife says, even if there were, no one would care to watch them anyway.

The cartoons we are presenting are meant to provide a respite from all the dull work (in the opinion of most of our friends). These cartoons give us a chance to laugh at ourselves and find humor in our work.

The general comments received so far ranged from the need to think to understand (dah!), funny, clever, unique, zany… to outright stupid. Well, we agree – it is working as it should.

We like to inform all our clients in advance, that there (is no/will not be) malicious intent in any of our cartoons. We will make fun of our clients, competitors, the government, industry participants, and the general society. Our work will not intentionally target anyone organization, person, or group. Since we have to draw the line somewhere –you can rest assured we will not make fun of ourselves, or anyone at Vice President Level (they sign our checks!)–Unless of course, we get special requests!

Hope you enjoy our work. As always, we are honored to have the opportunity to provide you with the best quality work.

Pemex to add HDPE/LLDPE swing capacity & looking for investors in massive polyethylene project

Pemex has announced its plans to add 660 million pounds of swing capacity for high and linear low-density polyethylene in 2006 and another 220 million pounds of HDPE capacity in 2007.

Pemex is also looking for outside investors for its $2.6-billion Phoenix Project, which consists of complexes producing olefins and derivatives, and aromatics in Mexico. The company plans to construct two massive petrochemical complexes, in either Altamíra or Coatzacoalcos, by 2008.

Comments: Pemex is the largest supplier of polyethylene in Mexico. Pemex currently has around 300KT of HDPE capacity. Its current capacity is based on Asahi and USI processes. These facilities are located in Morelos and Poza Rica.

Mexico does not have any LLDPE capacity, and currently, all its LLDPE demand is satisfied through imports. Among the different polyethylenes, HDPE is the most widely used PE in Mexico while LLDPE is the least. LLDPE accounts for about 20% of the total polyethylene consumption, while HDPE accounts for 48% of the PE consumption. Pemex has selected Univation’s Unipol PE technology for the 660-pound swing plant. In addition to high-density polyethylene, the new plant will be the first in Mexico to produce LLDPE and metallocene LLDPE. All three types of PE will be made using Univation catalysts.

Pemex had recently presented a paper on “What’s ahead for Pemex Polyolefins” at FlexPO 2003, held on Sept. 17-19, 2003 at Galveston, TX.

Eastman Chemical to eliminate more jobs

Eastman Chemical announced its plans to eliminate an unspecified number of jobs due to rising labor costs. The company was going through its annual budgeting process when it made this decision. According to Eastman, forecasts indicate that labor costs are expected to rise about 8%-10% next year.

In August 2003, Eastman announced its plan to cut 2,400 jobs in its coatings, adhesives, specialty polymers, and inks (CASPI) division. The company plans to sell, restructure, or close some underperforming CASPI product lines. Those underperforming businesses had reported a combined operating loss of $75 million.

National Petrochemical (NPC) in high-density polyethylene talks with Itochu

National Petrochemical Co (NPC) is in talks with Itochu Corp on a possible investment in a 300,000 MT/year high-density polyethylene (HDPE) facility in Assaluyeh, Iran.

According to NPC, the proposed HDPE project will not be part of either of the cracker complexes, Olefins No9 and Olefins No10 that the company is building in Assaluyeh. But feedstock for the project could come from the complexes. NPC will have about 300,000 MT/ year of surplus ethylene from the 1 million MT/ year Olefins No9 and 1.35 million MT/year Olefins No10 crackers.

NPC has formed a joint-venture company with Sasol, named AriaSasol Polymers, for the Olefins No9 project, and its startup is expected in 2005-06. The Olefins No10 project, which NPC will run on its own, is expected to start up in 2005.

Comments: Japanese companies are known to be cautious about investing in Iran because of their past experiences. However, they are also aware of the benefits due to feedstock-cost advantage.

In the 1980s, a Japanese consortium led by Mitsui lost money in Iran due to the Iran-Iraq War. The consortium had formed a joint venture with NPC to construct a petrochemical complex in the 1970s. The joint venture was dissolved when the Japanese partners withdrew in 1989 after the 70%-complete complex was destroyed during the war. The money invested by the Japanese companies was never recovered.

Since then, Japanese companies have restricted themselves to providing engineering and funding to projects in Iran, without taking equity stakes in them.

Dow’s performance gets back on track

The return of Dow Chemical chairman William Stavropoulos as the company’s CEO in December 2002 prompted a drastic shakeup and restructuring at the company that has led to many improved results. Stavropoulos had replaced former CEO Michael Parker due to disappointing financial performance during the previous two years.

Upon his return, Stavropoulos had announced a plan to reduce annualized costs by at least $400 million, improve cash flow, and boost productivity. The company began its performance improvement drive in January 2003. Dow has been focusing on the things such as reducing structural costs and capital spending; aggressively managing price and volume; selling assets that are not a strategic fit; and closing down uncompetitive or underperforming assets.

The company has improved earnings and expects to generate enough cash flow to cover the cost of its dividend in 2003, for the first time in two years. First-half net income jumped 73%, to $478 million, on sales up 16%, to $16.3 billion.

During the first half of 2003, Dow’s research, selling, and administrative expenses were down 11% compared to 2002. According to Dow, that represents annualized savings of $500 million-well above the $ 400 million target announced in January. Dow eliminated 2,300 jobs in the first half, and it plans to reach the announced goal of 3,000-4,000 job cuts by year-end. The cost savings are in addition to the $1.1 billion cost reduction program launched after the company completed its acquisition of Union Carbide in 2001. The company plans to divest its assets that contribute revenues of $1.5 billion/year over some time.

The company has also shut down two former Carbide ethane-based crackers originally due to close by 2005 under a consolidation program. Its Texas City, TX unit was closed in June, and its Seadrift, TX cracker was shut in September. The company has also closed a foam insulation production site at Elizabethtown, KY obtained in its acquisition of Celotex in 2001; and a former Carbide site at Edison, NJ.

The company is finding ways to improve access to competitively priced natural gas supply and improve energy efficiency. It recently signed an agreement with Freeport LNG Development (Freeport, TX) for the long-term use of a proposed liquefied natural gas (LNG) terminal in Texas. The agreement could provide Dow with as much as 50% of its LNG requirements in the Gulf Coast regions.

Huntsman to decide in December on building the LDPE plant at Wilton, UK

Huntsman announced its plans to finalize its decision to build a 400,000 MT/year low-density polyethylene (LDPE) plant at Wilton, UK in December.

The company had announced its plans to build the polyethylene plant in Wilton, UK earlier this year and had not made a decision on which LDPE technology to use for the plant.

Comments: LDPE markets have realized higher operating rates in the last decade due to a tight supply-demand balance. In North America, there have been no grassroots LDPE plants since the 1980s. This has helped maintain higher operating rates for LDPE.

Owing to these reasons LDPE markets have been highly profitable and any capacity additions have been closely monitored. During the beginning of the year Huntsman had announced that it was planning to decide by April 2003 to add a 400 KT LDPE plant at Wilton, UK. However, Huntsman seems to be reconsidering the plans because of various factors such as soft global economies, soft LDPE demand, and others. The discipline of bringing new capacities online has been one of the key factors influencing the success of LDPE. In current conditions, the industry will welcome Huntsman’s announcement to delay its decision on the LDPE plant till December 2003.

Sonoco selling HDPE film unit to Hilex Poly Co.

Sonoco Products announced the sale of its high-density polyethylene (HDPE) film unit to Hilex Poly Co. LLC, a company owned by investment firm HPC Group of Cos. The owner of HPC, Leon Farahnik is one of the former owners of Sunoco’s bag operations.

HPC will pay $123 million for the business, including $85 million in cash plus subordinated notes and preferred nonvoting membership interests. The business had sales of about $89.5 million for the first six months of 2003. The deal includes five plants including (1) Hartsville, SC, (2) Milesburg, PA, (3)Mount Olive, NC, (4) North Vernon, IN, and (5) Victoria, TX. The sale is expected to close in the fourth quarter 2003.

Sonoco’s film business is a major supplier of plastic grocery bags in North America. Sunoco’s HDPE film operation includes the blown film extrusion of polyethylene for grocery bags, retail bags, T-shirt roll bags, agricultural mulch film, quick-service restaurant bags and produce bags.

Comments: Sonoco is continuing to streamline its assets and sell its noncore operations in an effort to improve its profitability.

The sale will take the Hilex business full circle since Farahnik sold Hilex to Sonoco in 1989. Farahnik is re-entering the plastic-bag sector with financial backing from Atlanta-based DCH I Investment Holdings LLC, an affiliate of private equity firm Dewberry Cesinger Hodgson.

The polyethylene bag market has been facing stiff competition from cheaper bags imported from China. Domestic producers have been losing market share/pricing power due to the import of cheaper bags. The polyethylene bag market has also been facing some competition from cheaper bimodal resins coming from Asia. Bimodal resins reduce the overall cost of the bag as they can be downgauged.

The current grocery-bag market is highly fragmented, with many smaller producers competing with Hilex, and this sale could lead to more consolidation in the industry. It seems consolidation may be an effective strategy to lower costs and improve competitiveness in the current business environment.

Georgia Gulf’s operating income drops due to weak chlorovinyls

Georgia Gulf expects a fall in its operating income at below $27.6 million in its chlorovinyls segment due to lower polyvinyl chloride (PVC) prices and an outage at its Plaquemine, LA vinyl chloride monomer plant. Georgia Gulf expects third-quarter earnings to be 15-18 ¢/share ($4.9-$5.8 million), excluding a one-time gain from a lawsuit settlement.

PVC volumes are set to increase by 10% from the second quarter because of strong demand in construction. Georgia Gulf expects margins in its phenol-acetone business to improve in the third quarter, despite lower prices, because of declining benzene and propylene feedstock costs. Georgia Gulf posted a second-quarter operating loss of $900,000 in its phenol-acetone business.

Comments: Georgia Gulf, headquartered in Atlanta, is a major manufacturer and marketer of two integrated product lines, color vinyls, and aromatics. Georgia Gulf’s chlorovinylsproducts include chlorine, caustic soda, vinyl chloride monomer, and vinyl resins and compounds. Georgia Gulf’s primary aromatic products include cumene, phenol, and acetone. The company is the second-largest North American producer of vinyl compounds and the third-largest North American producer of VCM and vinyl resins.

Georgia Gulf’s plant in Plaquemine, LA had an outage that occurred on July 31, 2003, and the plant was restarted on August 14, 2003. The company’s net income will reduce as a result of the fixed manufacturing expenses being absorbed by lower production and the costs associated with the repair of the plant.

Asahi Kasei and Shanghai Gaoqiao Petrochemical to form a joint venture for a synthetic rubber plant in China

Asahi Kasei has started the feasibility study to build a synthetic rubber complex downstream from the BP-Sinopec joint venture Secco Petrochemical in Caojing, China.

Asahi Kasei and Shanghai Gaoqiao Petrochemical will form a joint venture that would include 100,000MT/year styrene-butadiene rubber to supply the local tire industry and a butadiene rubber plant. Asahi Kasei would be the first Japanese producer to manufacture synthetic rubber in China.

Comments: The demand for synthetic rubber, especially styrene butadiene (SB) rubber is expected to increase in China at about 10-12% per annum. Moreover, the Chinese Ministry of Commerce recently imposed an anti-dumping duty on SBR imports originating from Japan, South Korea, and Russia.

Asahi Kasei is one of the major producers of SB rubber in Japan. In order to take advantage of the growing market, and to avoid the heavy duties, the company is considering the option of constructing the plant in China.

Showa Denko KK to absorb its polychloroprene manufacturing subsidiary, Showa Denko Elastomers

Showa Denko K.K. (SDK) has announced its plans to absorb its wholly-owned subsidiary Showa Denko Elastomers K.K. for the production of Shoprene®polychloroprene rubber, effective January 1, 2004. This will allow Showa Denko to develop new grades and applications to meet the growing need for the product.

Upon the dissolution of a polychloroprene joint venture with a foreign producer in November 2002, SDK established Showa Denko Elastomers K.K. as a manufacturing company. At the same time, SDK started marketing the product under the new trade name Shoprene.

Shoprene sales are expanding steadily due to brisk demand in China and Southeast Asian countries as well as SDK’s material development technology and customer support setup.

By absorbing Showa Denko Elastomers K.K., SDK will integrate the development, production, and marketing of Shoprene. In addition to the facilitation of grade/application development, SDK will increase efficiency and strengthen the cost competitiveness of the business.

SDK will also strengthen its Elaslen chlorinated polyethylene, Ecoflamer low-halogen flame-retardant elastomer, and fluorinated rubber operations, aiming to achieve synergies.

Comments: Polychloroprene rubber or chloroprene rubber (CR), introduced in 1931, was the first synthetic rubber developed that showed the elastomeric properties of natural rubber. CR is one of the most important specialty elastomers with a global demand of about 650 million pounds globally.

About 60% of polychloroprene rubber is used in the manufacture of rubber goods such as molded goods, cables, transmission belts, conveyor belts, and others. The other major application of CR includes its use as a raw material for adhesives. The other applications of polychloroprene rubber include latex applications such as dipped articles, molded foam, rubber modifiers for asphalt products, and others

.DuPont is the only North American producer of chloroprene rubber. The other major producers include: (1) Bayer, and (2) Showa Denko Elastomers.

Dow Chemical Company completes Seadrift Olefins plant shutdown as planned

The Dow Chemical Company shut down Union Carbide, Seadrift, Texas, Olefins plant. The plant stopped operating on September 12, 2003. The Seadrift cracker had been in operation since 1960, and in its 43-year history produced approximately 35 billion pounds of ethylene.

The closure of Carbide’s Seadrift Olefins plant is part of Dow’s comprehensive US Gulf Coast Ethylene Review which Dow announced in late 2001. The supply to downstream businesses will be covered through internal and affiliate swaps from increased production at other crackers and through the implementation of purchase agreements already in place. The Texas City Olefins plant was safely taken out of operation on June 16, 2003.

Comments: Natural gas prices have been on the rise in the last few years. The increase in natural gas prices has changed the dynamics of feedstock use in the United States. As natural gas prices increase naphtha becomes equally competitive feedstock. The Seadrift cracker was based on natural gas liquids and was one of the most expensive crackers for Dow. In light of increasing natural gas prices, Dow has decided to shut down the inefficient cracker and shift its production to other efficient crackers. Dow had originally planned to close this plant in 2005 but owing to current conditions the closure was moved to an earlier date.

Hyosung to invest $210 Million for expansion of its spandex operations

Hyosung has announced its plans to invest $210 million towards increasing its global capacity for spandex fiber by 50 percent over the next three years. The company will invest $140 million to build a spandex plant in Europe and invest $70 million to expand its plant in Guangdong, China. The location of the European site is not determined. The scheduled completion date for additional capacity is scheduled for September 2004, and the European facility is expected to start by September 2006.

Upon completion of both expansions, the company will have an annual capacity of more than 50,000 metric tons of Creora spandex.

According to the company, its spandex business is growing at 40% per year. Currently, it has two spandex plants in South Korea, and the capacity is being increased from 15,000 MT/year to 25,000 MT/year at its Chinese facility. The scheduled completion for the expansion is January 2005.

Hyosung plans to supply spandex to North America from its European facility upon construction. The company currently supplies spandex to North America from its Asian facilities.

Comments: Spandex, popularly known as Lycra has set standards for elastic fibers. Lycra essentially followed the suit of the rest of all DuPont’s successful products in creating, establishing, and growing the markets through innovations.

The recent industry developments have extensively focused on alternatives to Lycra, elastomeric fibers -including SEBS fibers, polyethylene fibers, polypropylene fibers, etc. We are planning on focusing on one issue of New Generation Polyolefins Bimonthly Review to chronicle the upcoming role of polyolefins and elastomers in elastomeric fibers.

Henkel uses Ticona’s Topas® cyclic olefin copolymer for an integral barrier layer in cardboard packaging

The Henkel Group relies on a novel type of cardboard packaging for its Sil® stain removal powder. The company uses Ticona’s Topas® cyclic olefin copolymer (COC) due to its excellent moisture barrier properties. Henkel was able to dispense with an additional plastic film wrapper and integrate the moisture barrier directly into the cardboard packaging. At the same time, the plastic content is kept low enough to fulfill Germany’s Green Dot criteria for eco-friendly paper packaging. The cardboard packaging is supplied by VG Nicolaus GmbH.

A high level of moisture protection was previously ensured by providing the cardboard packaging with a plastic film wrapper. This outer packaging required an additional processing step, which complicated machine configurations and was more expensive. In a joint development, Henkel, VG Nicolaus (VanGenechten Nicolaus GmbH), and Ticona pioneered an innovative solution. Their goal was to develop a cardboard pack without a plastic film wrapper or inner bag. Hence the cardboard itself had to incorporate a high moisture barrier. Topas® cyclic olefin copolymer (COC) from Ticona offered an excellent moisture barrier effect.

VG Nicolaus manufactures the Sil® stain remover pack in Kempten, Germany. The first step involves the production of barrier cardboard. The cardboard and paper are extrusions laminated with the Topas® COC barrier layer and blanks are cut. These can then be printed and folded like conventional cardboard in a subsequent manufacturing operation.

Ticona, Celanese AG’s technical polymers business, has announced that it will eliminate 140 jobs in selling, general, and administrative (SG&A) functions in Europe and the US. The reductions will amount to 19% of Ticona’s SG&A staff in the US and 16% in Europe. In the second quarter of 2003, Ticona’s sales had dropped by 10% to €181 million ($208 million), due to pressure on prices.

Comments: Cyclic Olefin homopolymers and copolymers are engineering thermoplastics derived from norbornene molecules. Norbornene is made from dicyclopentadiene (DCPD) and ethylene. These resins have glass-like transparency, low dielectric loss, low moisture absorption, dimensional stability, high heat resistance, and high melt-flow rates.

The polyolefins industry is familiar with TPX, Poly-4-methy-1-Pentene from Mitsui. TPX was unsurpassed in its clarity/toughness/heat resistance balance and is still considered the benchmark for clarity applications worldwide. TPX did not progress as it should, because of the lack of economies of scale.

Cyclic olefins introduced by Ticona targeted the TPX markets. The current developments in cyclic olefins are justifiably focused on optical media and electronics where their higher cost would be justified.

There are currently four major suppliers of these resins: (1) Nippon Zeon, (2) Mitsui, (3) JSR, and (4)Ticona.

Cyclic olefin copolymers are used in the flexible packaging industry as a blend component or as a discreet layer in multi-layer polyolefin films. They enhance the stiffness and heat resistance in food packaging applications.

The potential applications for cyclic olefins can be broadly classified into two types: (1) specialty products and (2) very high-value/low-volume applications. The developments in packaging, clarity applications, and labware fall into the specialty classification. The products that combine the unique clarity/di-electric properties in electronic and optical media represent very high value/low volume applications.

Teknor Apex introduces new grades of FreeFlex™ compounds using technology for alloying PVC with polyolefin elastomers

The vinyl division of Teknor Apex introduced four grades in the FreeFlex™ 4002 series with Shore A hardness ratings of 81, 82, 85, and 90. These grades are a result of a combination of polyvinyl chloride (PVC) and polyolefin elastomers (POEs).

These flexible vinyl compounds perform better than conventional plasticized PVC at high and low temperatures and avoid problems caused by plasticizer volatilization or migration.

The company claims that products manufactured from these compounds avoid embrittlement and provide as-new performance after prolonged service under challenging conditions. Teknor Apex plans to target applications such as hose and tubing and sheet products such as tank and pond liners using these compounds.

The company plans to price the new compounds approximately 40 to 80% higher than high-performance conventional vinyl with low-extractible, low-volatility polymeric plasticizers.

The technology underlying new FreeFlex compounds involves (1) the use of high-performance new-generation POEs immiscible with PVC, and (2) the development of proprietary compatibilizer chemistry to alloy them with PVC.

Department of Justice subpoenas label makers Avery Dennison and Bemis

Department of Justice (DOJ) issued subpoenas to label makers, Avery Dennison (Pasadena, CA), and Bemis (Minneapolis) in connection with a DOJ probe of competitive practices in the pressure-sensitive label stock industry.

DOJ disclosed its probe of the industry earlier in 2003 when it filed a complaint seeking an injunction to block the planned $420-million sale of Bemis’ MACtac pressure-sensitive materials business to UPM-Kymmene (Helsinki, Finland), parent firm of label stock producer Raflatac. According to DOJ, a merger of Raflatac and MACtac, the second-and third-largest North American producers of pressure-sensitive label stock, would have created a company with a market share of close to 25%, and the merged entity together with Avery would account for more than 70% of total North American sales.

The US District Court for the Northern District of Illinois granted DOJ the injunction in July, and Bemis and UPM called off the planned transaction shortly afterward.

Comments: The Department of Justice formally launched an investigation on April 15, 2003, into the blocked merger of $420 million between UPM-Kymmene Corp. and Bemis. Avery Dennison is the largest producer of labels and pressure-sensitive materials in North America.

Dissolvable plastic packaging unveiled

Australian company, Plantic Technologies has introduced a new type of biodegradable plastic. Known as Plantic®. The plastic is made from corn starch and was developed by the company and the Co-operative Research Centre for International Food Manufacture & Packaging Science.

The initial applications of Plantic include the manufacture of dry goods and food packaging for foods such as biscuits and chocolates. Plantic Technologies claims that Plantic decomposes at a much quicker rate than other forms of biodegradable plastics, as well as being much cheaper than traditional petrochemical-based plastics.

Comments: The biodegradable plastic produced by Plantic Technologies is derived from high-amylose corn with a longer molecular structure.

The cornstarch-based plastics initially started in India and spread to the U.S. several organizations in the U.S. developed packaging peanuts to replace the polystyrene foam peanuts.

The concept was that once used they could be flushed down the drain with water. However, due to low bulk density, polystyrene foam peanut replacement is complicated by logistics issues– too expensive to ship.

The other attempts to manufacture disposable spoons and forks resulted in breakage and potential child/simple-minded adult endangerment due to accidental swallowing – the same problem currently faced by most biodegradable plastics.

Cargill‘s R&D center plans to develop soy-based polyols

Scientists from Cargill and the Kansas Polymer Research Center (KPRC) at Pittsburg State University (PSU) in Kansas have agreed to conduct joint research on the development of soy-based polyols for the urethane industry. The alliance will focus on creating new industrial products from soy polyols for use in a broad range of applications for the polyurethane industry such as foams, coatings, adhesives, and sealants.

According to Cargill, the research is aimed at replacing petroleum-based polyols and was initiated due to the industry’s need to find renewable alternatives to petroleum. Vegetable-based alternatives to petroleum also would release less carbon dioxide into the atmosphere and free industry from the unstable politics of major oil-producing regions.

The company’s bio-based alternatives to petroleum include a biodegradable hydraulic fluid made with canola oil and a soy-based transformer fluid for utility companies. Cargill announced an initiative in early 2003 to accelerate its development of specialty chemicals, polymers, and other industrial products made from renewable agricultural sources.

The company plans to first develop products for PU foams applications and then apply the research to all major market sectors for PU, including plastics, inks and coatings, adhesives, films, sealants, and other products.

Comments: The United Soybean Board (USB) has identified six market segments of polyurethane in which soy-based polyols have the maximum potential. They include (1) construction (residential and commercial buildings; refrigerated buildings; walk-in coolers; molded millwork; laminated insulated board block; insulation; insulated doors and metal panels), (2) transportation, (3) carpet (flexible foam and fiber backing), (4) appliances, (5) packaging(foam packaging and pallets) and (6) tanks & pipes.

Urethane Soy Systems Company (USSC) is the largest supplier of soy polyols to the US polyurethane market. The company’s product SoyOyl® is used in carpet backing, rigid foam insulation, pickup truck bed liners, and structural foam.

Soy polyol has several advantages including (1) competitive cost, (2) supply stability, and (3) reduced dependence on imported oils for plastics. Cargill has been very active in the research and development of vegetable-based replacements for petroleum products.

Hurricane Isabel causes minimum damage to east coast plants

Hurricane Isabel did little damage to chemical plants when it hit the U.S. East Coast. There were power outages but no production was lost as a result. Nova Chemicals shut down its 200-million lbs/year polystyrene plant at Chesapeake, VA as a precaution but did not sustain any damage. DAK Americas operated their plant normally through the storm with no setbacks. DAK has a purified terephthalic acid plant at Wilmington, NC, and polyethylene terephthalate plants at Fayetteville, NC, and Cooper River, SC.

Bayer closed the headquarters of its Bayer CropScience business at Research Triangle Park, NC; and its biological products manufacturing facilities at Clayton, Raleigh, and Research Triangle Park, NC on Thursday.

Motiva a 50-50 joint venture between Shell and Saudi Aramco in Delaware City reduced operating rates at its refinery in anticipation of the storm. The plant produces methyl tert-butyl ether and benzene. None of the Sunoco Chemicals facilities at Neal, WV, and sites in Pennsylvania were affected.

Teijin Corporation develops innovative fiber composite – a new direction in future textiles

Teijin Corporation has developed Morphlex, an iridescent color-changing fiber based on nanoscale nylon-polyester laminate. The fibers mimic the coloration mechanism found in the wings of South American morpho genus butterflies. The fiber will refract different colored light depending on the angle and intensity of light. Teijin started producing the fiber at its Matsuyama, Japan site.

Comments: Teijin’s development represents the first commercial application in the public domain.

Most of the work related to light-sensitive fibers and fabrics in North America is conducted by the Natick Army Research Center for Textiles. The U.S. Army’s goal was to develop a light-sensitive fabric for use in army uniforms to serve as camouflage and concealment situations.

U.S. Army Natick Research Center has recently introduced a fabric that would gradually change the design to match the surroundings. For example, a soldier walking in the forest will be indistinguishable from the trees around him/her; a soldier walking in a desert will be indistinguishable from the desert surroundings; a soldier fighting urban warfare standing by a brick wall will become indistinguishable from the brick wall.

The light-sensitive fabric and textile technology pioneered by U.S. Army Natick Research Center will have tremendous commercial applications in the future. Most of the fibers are based on aramids, polyester, polypropylene, and combinations thereof.

NPC (Tehran, Iran) to build the petrochemical complex after Shell and Basell pull out

The planned Olefins 8 complex was to be based on a 1.1 million MT/year ethane cracker unit including units for HDPE, MDPE, and glycol. Following the feasibility study, the original partners Shell and Basell backed out of the program. In the past BP pulled out of the same program citing a poor demand outlook.

NPC decided to go ahead with the program and plans to invite Technip, ABBLumus, and Linde for the bids on engineering, procurement, and construction.

Basell is still expressing an interest in building a newer LDPE plant based on Basell’s technology.

Comments: Iran is in the middle of a perfect storm of (1) the Iraq war and Allied occupation, (2) the situation in Afghanistan, (3) the Mid-East Crisis, and (4) the on-again/off-again conflict with the United States.

The uncertainties combined with the lack of consistent demand make many organizations hesitant to continue the plans.

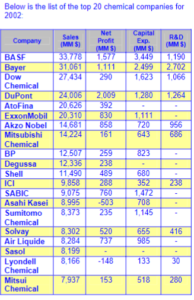

Top 20 chemical companies for 2002

Comments: Over the last thirteen years, Chemical Market Resources, Inc has worked with almost every company listed above.

Contact us at ADI Chemical Market Resources to learn how we can help.