My Turn –Growing Exodus of Basic 6 and Level I Operations by Traditional Organizations Dr. Balaji B. Singh

Globalization trends are here – As more and more developing countries are focused on monetizing raw material, labor, and investment-advantaged commodity products, the traditional players, especially in North America and Europe are packing their bags and retrenching either upstream (limit their activities cracker plus 2 ) or move downstream to level II and III products to optimize the value addition process – Nova, GE Plastics, Dow, Huntsman, Eastman, and others. Essentially, the basic 6 and level I products are being handed over to financial buyers/operators – mainly to distance themselves from the raw material fluctuations.

Even developing countries are facing the same situation and are on the verge of discouraging any more basic 6 and level I product developments. The Ministry of Petrochemicals in the Kingdom of Saudi Arabia declared – if you plan to come to Saudi Arabia to build yet another cracker with polyolefins – don’t bother – come only if you are willing to develop level II and III value-added products.

Since the innovation is at its lowest point (it has been nearly 60 years since a new commodity polymer had been invented) and most organizations are happy making incremental changes in value addition in the name of innovation, maybe the time has come for the industry to accept that no new products can be developed and focus more on developing alternative feedstocks for the existing products – bio, natural gas, etc.,

Huntsman sells its commodities business to Flint Hills Resources

Huntsman Corporation announced the signing of definitive documents with Flint Hills Resources, LLC, a wholly-owned subsidiary of Koch Industries, Inc., for Flint Hills Resources to acquire Huntsman’s U.S. Base Chemicals and Polymers business.

Huntsman is expected to realize a total value from the sale of approximately $761 million. Under the agreement, Flint Hills Resources will acquire the manufacturing assets of Huntsman’s U.S. commodities business for $456 million in cash plus the value of inventory ($286 million on Dec. 31, 2006) on the date of closing. Huntsman will retain other elements of working capital, including accounts receivables, accounts payable, and certain accrued liabilities (net, $19 million on Dec. 31, 2006), which will be liquidated for cash immediately following the closing.

The transaction includes Huntsman’s olefins and polymers manufacturing assets located at five U.S. sites: Port Arthur, Odessa, and Longview, Texas; Peru, Illinois; and Marysville, Michigan. The business employs about 900 associates. The captive ethylene unit at the retained Port Neches, Texas, site of Huntsman’s Performance Products division is not included in the sale. This asset, along with a long-term post-closing arrangement for the supply of ethylene and propylene from Flint Hills to Huntsman, will continue to provide feedstock for Huntsman’s downstream derivative units.

Subject to customary regulatory approvals and other closing conditions, the transaction is expected to close during the third quarter of 2007 following the re-start of Huntsman’s Port Arthur, Texas, olefins manufacturing facility.

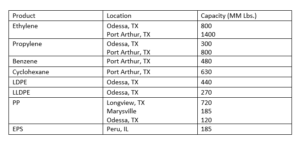

Comments: Huntsman had made announcements to divest its commodity business and focus more on differentiated products. This sale seems to be the last step of the transformation. The following assets are being sold to Flint Hills Resources:

Huntsman will retain the 95 million pounds APAO facility at Odessa, TX but Flint Resources will operate the facility. Huntsman has also retained the facility at Port Neches, TX. The Port Neches, TX facility produces 400 million pounds of ethylene and 800 million pounds of propylene. The facility also produces butadiene and MTBE. On February 24, 2006, Huntsman announced the sale assets of their U.S. butadiene and MTBE business located at Port Neches, Texas, to Texas Petrochemicals, L.P. We expect the transaction to close in mid-2006. The manufacturing facility has a capacity of approximately 900 million pounds of butadiene per year and approximately 11,000 barrels per day of MTBE.

The Odessa, Texas olefins plant produces both ethylene and propylene. Ethylene is transferred to LDPE and LLDPE for polymerization and is also utilized in polypropylene and APAO copolymer production. Ethylene capacity is greater than the current polymer capacity. To maximize ethylene production, Huntsman produces cryogenic ethylene and sells it via tank car to customers without pipeline access. There are only two other sellers of liquid ethylene, Equistar, and Eastman. Huntsman claims to sell this product at a significant premium to market pricing for pipeline-delivered ethylene.

The Longview, Texas facility uses the UNIPOL® gas phase production technology to produce polypropylene. This facility is connected by pipeline to the Mont Belvieu, Texas propylene supply grid and has recently added railcar unloading infrastructure, giving it maximum raw material supply flexibility. The Marysville, Michigan facility’s technology is mainly used for making TPOs. The Peru, Illinois EPS facility is one of the world’s largest EPS production facilities, with five reactors.

The company produces a variety of grades of LDPE using both the tubular and autoclave processes. Many of the resins are designed to meet the specific requirements of particular end users. Various types of conversion equipment, including extension coating, blown and cast film extrusion, injection and blow molding, and other proprietary methods of extrusion, use these differentiated polyethylene resins to provide high clarity, durability, and sealability performance characteristics.

LLDPE products by Huntsman contain octene copolymers and are sold into applications that require high-performance properties such as strength, clarity, and processability, and they contain few resin imperfections (low gel). These products are used in a wide variety of applications such as high-performance flexible packaging, high-clarity shrink films, barrier films, medical products, artificial turf, and irrigation tubing.

Huntsman uses a variety of technologies to produce different grades of polypropylene and participates in a wide variety of polypropylene applications. PP from Huntsman is used in medical applications, caps and closures, higher-value automotive parts, consumer durables, and furniture. Huntsman produces in-reactor TPO products at the Marysville, Michigan facility. Their Odessa, Texas facility produces grades of polypropylene utilized for medical applications, specialty films, sheets, and electronics packaging.

Mitsui Chemicals licenses PP technology to Thai Polypropylene

Mitsui Chemicals, Inc. signed an agreement with Thai Polypropylene Co., Ltd. (TPP), a wholly owned subsidiary of SCG Chemicals Co., Ltd. (SCGCh), to license its polypropylene (“PP”) manufacturing technology. The technology will be used at TPP’s No. 3 Plant in Rayong Province, Thailand.

SCGCh is a petrochemical holding company of the Thailand-based Siam Cement Group. The plant is to be one of the main downstream plants under SCGCh’s new naphtha cracker project and is expected to be completed in 2010 with a design capacity of 400KTA.

Mitsui has already licensed the technology to the No.1 and No.2 Plants of TPP. The No.3 Plant will be licensed for the sophisticated manufacturing process which is being used in Osaka Works of MCI (300KTA). The plant will have a world-class production capacity of 400KTA, which will increase TPP’s total PP production capacity up to 720KTA.

SCGCh also has the plan to establish another 400KTA plant for manufacturing high-density polyethylene (HDPE) under MCI’s HDPE process technology. (The license will be provided to Thai Polyethylene Co., Ltd.).

Comments: It seems that Mitsui is relying on its licensing business to realize its corporate vision – “Chemistry, Innovation, Dreams” as part of the basic management framework of the MCI Group. Both the PP and HDPE technologies by Mitsui are competitive with others – Basell, Equistar, Borealis, etc. MCI is well known for its world-class technologies, and this license agreement reflects MCI’s customers’ trust and reliance on the company’s technologies. These new plants start up by SCGCh – the petrochemical holding company of the Thailand-based Siam Cement Group indicate its commitment to the polyolefins business.

The parent company – Siam Cement Group has become the largest and most advanced industrial conglomerate in Thailand with five strategic business units: Petrochemicals, Paper & Packaging, Cement, Building Products, and Distribution.

On a different but related note – Basell has announced recently that its joint venture in Thailand, HMC Polymers Co Ltd, has selected Basell’s Spherizone technology for a 300 ktpa PP plant to be built at Map Ta Phut, Rayong, Thailand.

SIBUR to invest in propylene and PP in Russia

Russian petrochemical company, Siberian-Ural Petrochemical announced its plans to build a new petrochemical complex in Tobolsk, west Siberia.

The USD 750 million projects will include production facilities for both propylene and polypropylene. Although details will not be finalized until the second half of 2007, the complex could go on stream in 2010 and produce 400-450 KT/year of PP.

Comments: JSC SIBUR Holding is a major subsidiary of JSC Gazprom, and specializes in the downstream processing of hydrocarbon and other materials under contracts with various manufacturing plants. JSC SIBUR’s products include rubbers (butadiene rubbers, butyl rubber latexes, and others), monomers (butadiene, isoprene, and isobutylene), polymers, fuels, lubricants, fertilizers, rubber goods, tires, and others

In the section of the polymer, JSC SIBUR Holding currently produces Low-density polyethylene (LDPE), High-density polyethylene (HDPE), Polypropylene (PP), Polystyrene (PS), ABS-plastics, Polyvinyl chloride (PVC), PET – Polyethylene terephthalate. JSC SIBUR’s polypropylene is currently consumed in packaging applications, tubes, bottles, and fibers. Tomskneftekhim, part of SIBUR holding is the largest producer of polypropylene in Russia.

The demand for polypropylene in Russia is currently at 410 KT, growing rapidly at 6% due to the increase in packaging and other applications. The polypropylene plants in Russia are running at capacities with the demand exceeding supply. JSC SIBUR’s construction of a propylene and polypropylene plant is in line to meet the growing demand for polypropylene in Russia.

Ticona to construct new UHMWPE GUR® plant in China

Ticona, the engineering polymers business of Celanese Corporation, announced today that it will locate a new GUR® ultra-high molecular weight polyethylene (UHMW-PE) facility at the Celanese integrated chemical complex in Nanjing, China. The new, world-class 20,000 metric ton plant will increase the company’s global GUR UHMW-PE capacity to 90,000 metric tons and is expected to begin commercial operations in the second half of 2008.

Celanese is currently developing its fully integrated acetyls complex at the Nanjing Industrial Park site, which consists of a 600,000 metric-ton acetic acid facility, a 300,000 metric-ton vinyl acetate monomer plant, and a 100,000 metric-ton acetic anhydride unit. The company is also constructing specialty acetyl derivatives units to produce vinyl acetate-ethylene emulsions and conventional emulsion polymers.

Comments: Ultra High Molecular Weight HDPE (UHMW – HDPE) has polymer chains 10 to 20 times longer than high-density polyethylene. UHMW HDP is a polyethylene homopolymer with Mw ranging from 3 to 6 million made in a slurry process using a Ziegler catalyst. The longer chains give UHMW HDPE major advantages in toughness, abrasion resistance, and freedom from stress cracking. Since it is polyethylene it shares the lubricity, chemical resistance, and excellent electrical properties of conventional HDPE. The long chains are also responsible for the difficulty encountered in processing the material on conventional molding and extrusion equipment. When heated above the melting point it becomes clear but does not flow.

Ticona is one of the leading producers of UHMWPE under the trade name GUR®. The company invested in capacity expansion in 2003.

UHMW HDPE is used in gears or snowmobile drivers and impellers for snow blowers, where it provides low-temperature toughness, corrosion resistance, and lubricity. In the mining industry, it is used as a sliding surface in chutes and hoppers because of its excellent abrasion resistance and chemical resistance.

Chemtura to sell EPDM and certain rubber chemicals businesses to Lion Copolymer

Chemtura Corporation announced that it has signed an asset purchase agreement to sell its EPDM business; all Rubber Chemicals businesses associated with Geismar, Louisiana; and Flexzone(R) antiozonants worldwide to Lion Copolymer, LLC, an affiliate of Lion Chemical Capital, LLC.

Vinmar International (Mr. Vijay Goradia) is a major investor in Lion Capital LLC.

The transaction, which is expected to close by the end of the first quarter, is subject to certain conditions, including regulatory approvals, financing, and a comprehensive financial audit. Chemtura will use the proceeds for the recently completed purchase of specialty lubricant producer Kaufman Holdings.

Subject to government approval and the actual completion of the sale, Lion also will purchase Chemtura’s interest in Chemtura-CNCCC Danyang Chemical Co., Ltd. After the sale, Lion will have complete responsibility for the company, including the operation of the Danyang, China, facility, which produces rubber chemicals.

. The approximately 190 employees who work at the Geismar and Danyang facilities are expected to become Lion employees, as are the approximately 25 sales, marketing, and R&D personnel related to the businesses being sold.

Chemtura will continue to manufacture other rubber chemicals at several facilities around the world and will market them through its existing sales and distribution network and appropriate marketing agreements.

The EPDM and Rubber Chemicals businesses being sold had revenues for the 12 months ended Sept. 30, 2006, of approximately $300 million. The transaction will be slightly dilutive to Chemtura’s 2006 and 2007 earnings.

Comments: The EPDM business of Chemtura originally started in 1965 when Uniroyal Chemical started producing Royalene EPDM. In 1996 Crompton acquired Uniroyal Chemical Corporation and merged with Witco in 1999, later in 2000 the company changed its name to Crompton Corp. Crompton and Great Lakes Chemical Corporation merged in July 2005 to form Chemtura Corporation.

The North American demand for EPDM in 2006 was close to 790 million pounds growing at 2.7%. Automotive application has the highest demand with 24% of the total consumption. Other major application for EDPM includes roofing, TPO, mechanical rubber goods, wire & cable, and others.

Lion Copolymer manufactures SBR (Styrene Butadiene Rubber), and the company bought the business from DSM on October 31, 2005. SBR is used primarily in the tire industry as well as applications for industrial uses such as belts, hoses, and gaskets.

The sale of EPDM will allow Chemtura to concentrate on its core business. The company is a global manufacturer and marketer of specialty chemicals, crop protection, pool, spa, and home care products. The EPDM business will complement Lion Copolymer’s product portfolio.

BASF to invest in engineering thermoplastic Ultraform®

BASF is expanding the production capacity for its engineering plastic Ultraform® at the Ludwigshafen site. The expansion from roughly 41,000 to 55,000 metric tons per year will be completed in the first quarter of 2008.

BASF announced that it has started the construction of a new plant for the production of the base material DHDPS in Ludwigshafen, Germany. The plant will have an annual production capacity of 6000 metric tons. DHDPS (dihydroxy diphenyl sulfone) is a feedstock for the manufacture of the high-performance plastic Ultrason® E (polyether sulfone: PES).

Comments: integration of BASF into the manufacture of raw materials for PES will improve its cost economics and it also fits well with the company’s overall “Verbund” strategy. This announcement is in line with the company’s previous announcement to increase PES and polysulfone capacity to 12,000 tons per year by the end of 2007.

PES is a super engineering plastic that exhibits a number of outstanding properties such as lightweight, heat resistance, strength, and transparency and is used for electronics components and membranes, as well as carbon fiber composites and a wide range of other materials that require these special properties. Among these uses, carbon fiber composites for aircraft applications are finding use in a broader range of components equivalent to as much as 3-4 times the amount conventionally used per aircraft, as the industry seeks to reduce fuel consumption by lightweight aircraft. As this trend gains momentum, demand for PES used in carbon fiber composites is seeing rapid growth.

Sumitomo is one of the other major producers of PES. It has received approval from major aircraft manufacturers for their material to be used. Solvay also produces PES under the trade name Gafone®. Recently Sumitomo Chemical increased its PES capacity from 3,000 tons per year to 5,000.

ExxonMobil Chemical to increase Oriented Polypropylene (OPP) film production

The Films Business of ExxonMobil Chemical announced its plans to significantly increase the production of specialty-oriented polypropylene (OPP) films in LaGrange, Georgia.

The company will upgrade the LaGrange facility to increase its North American capacity for multi-layer white OPP films. The multimillion-dollar investment will allow the company to satisfy the rapid growth in demand for specialty OPP films, such as OPPalyte™white opaque film for candy cold-seal applications, OPPalyte™ WOS-2 and STW white opaque films for ice cream novelty applications and Label-Lyte™ films for wet glue and pressure sensitive labeling.

ExxonMobil Chemical’s white opaque OPP films, each specifically tailored for targeted applications, have earned a reputation for outstanding performance that continues to fuel growth in the confectionery and ice cream markets. OPPalyte HM film, to be produced on the upgraded facility at LaGrange, utilizes a proprietary multi-layer technology to achieve exceptional cold seal adhesion. The company’s OPPalyte WOS-2 and STW films use proprietary multi-layer designs to provide optimal performance on multilane packaging machines commonly used for ice cream novelties.

This current upgrade is a continuation of ExxonMobil Chemical’s strategy to invest in specialty assets for its OPP films business. Since 2002, the company has added two new state-of-the-art orienteers, a new coater, and two new metallizers in its affiliated worldwide OPP film manufacturing facilities. Additionally, the company continues to upgrade existing assets like at LaGrange.

Comments: The BOPP film market has been growing globally at 8% to 9% per annum To keep pace with the demand there also has been significant addition in capacity, especially in China. However, the capacity utilization rates in China have been lower. The demand for specialty BOPP films such as white opaque and metalized BOPP films has been growing rapidly in North America. ExxonMobil seems to be changing its product mix to meet the demand for the faster-growing white opaque film market. The label market (that uses white opaque BOPP films) in North America has seen double-digit growth in the last five years. There are still inter-material substitution opportunities in this market and ExxonMobil will be able to address these opportunities by changing its product mix.

DuPont to open R&D center in India

E.I. DuPont announced its plans to establish a research and development (R&D) center in India. The company also plans to explore collaborations with large universities and scientific institutions in India in those areas of R&D work that are a natural fit for the country.

The DuPont Knowledge Center will be located in Hyderabad and is will have more than 300 scientists and other employees. DuPont has signed a Memorandum of Understanding with ICICI Knowledge Park for a long-term lease that will allow DuPont to construct its R&D facility on 15 acres of land in the park. The groundbreaking is slated for March and is expected to be fully operational in early 2008.

Research at the site will focus on integrated science – the addition of biology to traditional strengths in chemistry and materials science – to develop DuPont’s application pipeline in India and other emerging markets. The site initially will focus on molecular biology, bio-informatics, and polymer synthesis, with further R&D in the company’s application pipeline across all five of its business growth platforms.

The DuPont Knowledge Center is expected to house research programs for several businesses in addition to molecular biology research for DuPont subsidiary Pioneer Hi-Bred International, Inc. Other DuPont businesses include Crop Protection; Chemical Solutions Enterprise; Electronic Technologies; Surfaces; Building Innovations; Titanium Technologies and Performance Coatings.

Comments: This is a somewhat expected movement by DuPont, following other large US companies, consistent with the strategy of going where the growth is! DuPont intends to leverage competitive Indian science and engineering talent for the benefit of its customers and shareholders. Also, DuPont chose relatively less-crowded cities Hyderabad Vs Bangalore and other over-crowded cities for its R/D center to take advantage of this booming location – especially the city’s academic institutions, other high tech industries, relatively less expensive English-speaking labor force – well-educated engineers and scientists, and local government’s support.

After the IT wave that swept India in previous years, both the biotech and chemical R/D efforts are gaining momentum in India now. This emerging trend in India bodes well with DuPont’s long-term R/D strategy. DuPont is high on biotech R/D and chose the right time to establish its R/D efforts in India. We expect this trend – migration of US – R/D efforts to India will continue.

California approves the use of CPVC for hot and cold potable water distribution

The California Building Standards Commission (BSC) has approved a final Environmental Impact Report (EIR) prepared by the state’s Housing and Community Development (HCD) Department and approved the use of CPVC (Chlorinated Polyvinyl Chloride) pipes for hot and cold potable water distribution in houses, apartments, and hotels/motels anywhere in the state of California.

The state’s action comes after nearly 25 years of stops, starts, litigation, and environmental review. The EIR anticipates the market for CPVC pipe in California will swell by 2 and a half times, from the current 13 percent market share to an expected 32 percent compared to copper and other alternatives. CPVC has technically been allowed for use under the state’s plumbing code, but it was restricted to use in areas where soil or water conditions caused premature failure of copper pipe. It was also restricted to use in buildings no taller than 2 stories. BSC’s action in approving the EIR removes all restrictions on the use of CPVC in residential buildings, hotels, and motels.

Work on an environmental impact report began in 1982, shortly after IAPMO added CPVC to the Uniform Plumbing Code. Work stopped in the late 80s when California authorities decided an EIR was not necessary, but resumed again nearly 10 years later as a result of litigation.

Opponents of CPVC use now have 30 days to challenge the state’s findings. CPVC pipe meets the requirements of building codes throughout the United States and is also widely used in fire sprinkler systems.

Comments: CPVC is the only plastic that had a satisfactory performance for hot water applications. Polybutene -1 was discontinued because of the associated leakage problems. Approving CPVC for both cold and hot water problems will provide excellent opportunities for the construction industry.

Any objections in California to CPVC are rooted in the chlorine and PVC issues and not in the performance of CPVC as a polymer itself. The acceptance of CPVC in these applications will increase its demand and also provide a less expensive alternative for consumers. The major advantages include: (1) a service temperature of 90°C (190°F), accompanied by self-extinguishing properties, and (2) good weathering performance.

Klockner Pentaplast sells its flexible films business to Wipak

Klöckner Pentaplast Group, a global leader in film products, announced that it has reached an agreement for the sale of its flexible film business with Wipak, the packaging division of Finland-based Wihuri Group, subject to the final due-diligence process and anti-trust clearance.

The sites in Betzigau, Germany, Avanspack, Finland, and Nordpak, Finland are affected by this transaction.

The Klöckner Pentaplast Group is the world’s leading producer of films for pharmaceutical, medical devices, food, electronics, and general-purpose thermoform packaging, as well as printing and specialty applications. Founded in 1965 in Montabaur, Germany, Klöckner Pentaplast has grown from its initial facility to 23 current production operations in 12 countries.

Comments: This business was recognized as a non-core asset by the company and hence was divested. Klockner Pentaplast had expanded its operations in transverse direction-oriented shrink-label film production in Thailand and polyester films. The company also shut down the foils manufacturing plant in 2006 in the Netherlands. Overall company strategy is to expand in Asian regions.

This acquisition for Wipak seems to be a strategic fit. The company recently also acquired plastic packaging company Nordpak in Valkeakoski, Finland.

DuPont to introduce products with reduced PFOA content – eliminate the use of PFOA by 2015

DuPont announced significant progress in developing new high-performance products with reduced PFOA content that provide sustainable solutions for its customers and society in general.

In its fluorotelomer products, DuPont announced that it has successfully commercialized a new, patented manufacturing process that removes greater than 97 percent of trace levels of PFOA, its homologues, and direct precursors. While not used in the manufacture of fluorotelomers, PFOA is an unintended by-product. This achievement meets the voluntary U.S. Environmental Protection Agency (EPA) 2010/15 PFOA Stewardship program’s goal for these trace levels three years ahead of schedule. The new “LX Platform” products will be available to customers beginning in the first quarter. The “LX Platform” will be used for surface protection in segments such as paper packaging, fluorosurfactants, coatings, leather, stone, and tile.

In its fluoropolymer products, DuPont has reduced PFOA content in aqueous dispersion products using new DuPont™ Echelon™ technology. Through the use of Echelon™ technology, the company has reduced PFOA content in converted products by at least 97 percent. The technology will be used for durable coatings in applications such as electronics, industrial, architectural, and consumer products.

DuPont said that ongoing manufacturing modifications have resulted in its ability to continue to aggressively reduce PFOA emissions to the environment. DuPont had achieved a 94 percent reduction in global manufacturing emissions as of year-end 2006. The company projects that it will achieve reductions of 97 percent by the end of this year.

Comments: DuPont has established a huge market share in Teflon® type products. PFOA is a processing aid, used in the manufacturing process for Teflon®. By being able to eliminate/reduce PFOA in its product line, the company will be able to maintain its market share.

Contact us at ADI Chemical Market Resources to learn how we can help.